LazyPay Loan App Review: You can obtain an immediate personal loan through LazyPay without experiencing bank rejection. A reliable lending platform can be found through LazyPay. Loan apps have made borrowing easier and LazyPay maintains a position as one of the trusted options. The application contains three types of loan services for personal use as well as business requests and educational funding needs.

The following article presents an extensive examination of LazyPay’s Loan App to explain its fundamental elements and loan categories as well as application methods. People should assess loan platforms before application to prevent future complications in their borrowing experience.

What is LazyPay App?

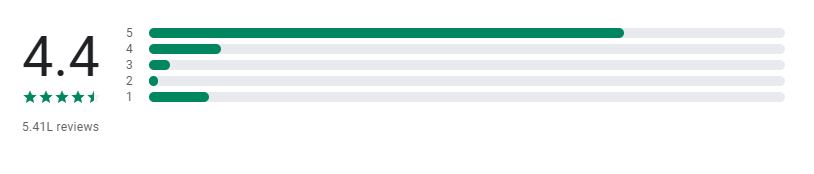

LazyPay Loan App operates as a rapidly expanding digital lending company that delivers secure complete financial services. The Google Play Store rates this application highly and users have downloaded it millions of times while enjoying its user-friendly approach to secured instant loans.

Customers of LazyPay gain access to personal loans along with credit cards and UPI payments in addition to the Buy Now Pay Later (BNPL) service. This platform is recognized for its efficient processing speed along with needing very little documentation from users.

LazyPay Loan App Technical Details

| Technical Details | Information |

| Technical Name | LazyPay Loan App |

| App Version | Version 8.4 |

| Developer | PayU Finance India Pvt. Ltd. |

| Organization | PayU Finance India Pvt. Ltd. |

| Total Downloads | 3 Crore + |

| App Size | 45 MB |

| App Compatibility | iPhone, Android |

| IOS Version | iOS 12.0 or Later |

| Category | Finance |

| Language | English |

| License | RBI-Registered NBFC |

| Price | Free |

Services Available on LazyPay App

LazyPay provides a wide range of financial solutions, making it a convenient app for users:

- Personal Loan

- Credit Line

- Buy Now, Pay Later (BNPL) Services

- Credit Cards

- UPI Payments

- Bill Payments & Recharges

Types of Loans Provided by LazyPay

- Personal Loan

- Credit Loan for Small Expenses

- Buy Now, Pay Later (BNPL) for Online & Offline Transactions

Features of LazyPay Loan App

- Loan amounts ranging from ₹10,000 to ₹5,00,000

- Instant approval and quick disbursal

- Flexible repayment tenure from 3 months to 2 years

- Interest rates starting from 15% per annum

- Annual Percentage Rate (APR) from 18% to 36%

- 100% digital loan application process

- No collateral required

- Easy credit line for online shopping & bill payments

- OTPs, CVVs or PINs not required

Is LazyPay Loan App Genuine?

Users need to verify the authenticity of their planned loan app usage before its application. LazyPay operates as a trusted digital platform which demonstrates its authentic RBI-registered NBFC support.

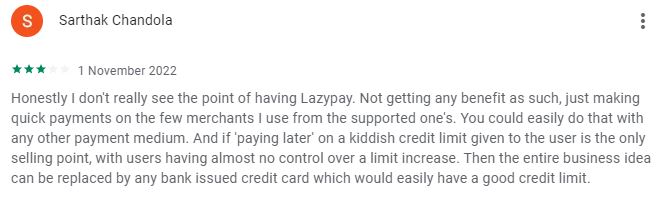

User Reviews & Feedback

Positive Comments:

- Very useful app. I am using it for recharge… electricity bill pay…etc… one problem is I couldn’t verify my mobile… please fix this issue.. thanks to lazypay team

- Best PayLater App, Excellent service and quick allocation of funds in your account without any unnecessary hassle. 5 stars from my side and will recommend all my friends and family members for sure.

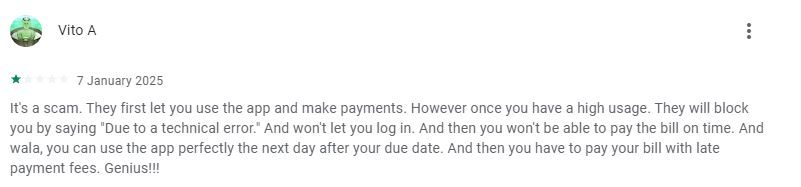

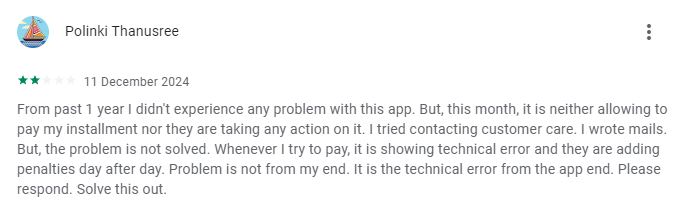

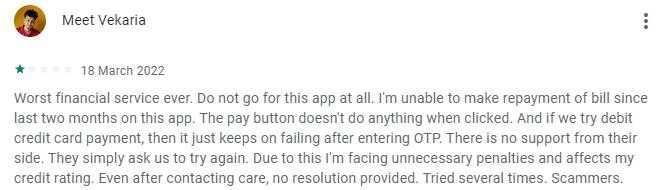

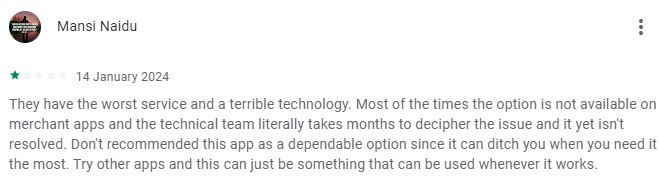

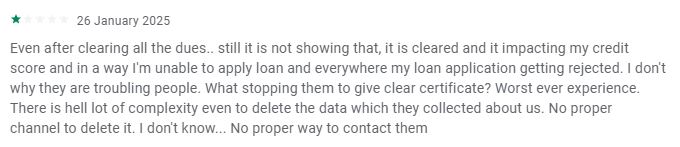

Negative Comments

- Worst experience, I have been using it for 4-5 months, and in the list of transactions it is showing extra expenses (which I did not do), the number for help is unreachable all the time, they fool!! Every month they fine me extra! Because before paying I just wanted to check the original transaction.

- Hey! I have been trying to contact them but there’s no customer care. I have Paid my bill on time and the transaction is successful from my side. But it shows ‘failed’ in the app. I have been trying to mail also in the given feedback mail no. But there is no response and they are increasing my late fees everyday. And the email you provide does not exist.

Users Review Screenshots

Final Review

As the LayPay loan app has a low trust score, we do not force the people to take loans from this loan application. If you are checking all the reviews given by the real users then you will make a good decision for yourself. We have provided some screenshots above about the reviews and feedback. So check our blog for more reviews on other loan applications to take personal loans without fear.

Conclusion

Users seeking fast personal loans together with simple credit line features should consider LazyPay Loan App as their preferred solution. LazyPay provides borrowers with a straightforward loan application system that offers numerous financial options for simplified borrowing. Users need to examine interest rates together with fees experienced during the process of obtaining a loan.

Users seek instant personal loans and BNPL services from LazyPay which provides an appropriate solution. Complete examination of terms and conditions should take place before continuing with transactions.

Disclaimer

The blog Apploan.in only provides the real review including final thoughts on the particular loan app. It is your decision whether you can take out a loan or not from the provided loan app. We are not at all responsible if you have got scammed by these loan applications. And remember these are all private and Non Banking loan providing organizations. Hence the interest rate will always be higher compared to the banking system. Think and take steps towards a better financial future.

Important Contact

Contact Number: 02269821111

Email Address:wecare@lazypay.injfkilpvpdfjdnk

Address: Empresa Building, Sixth Floor, Second Road, Khar West, Mumbai – 400 052, Maharashtra, India

Important Links

LazyPay Loan app official Website: Click Here

Download LazyPay Loan App from Google Play Store: Click Here

Download LazyPay Loan App from App Store: Click Here

Join Whatsapp Group: Click Here

Join Whatsapp Channel: Click Here

Read Also

- $500 Dollar Loan: Get Instant 500 Dollar Loan Online in the USA 2025

- SmartCoin Loan App Review 2025: Real or Fake? How to Apply for Loan in SmartCoin App?

- Olyv Loan App Review 2025: Real or Fake? How to Apply for Loan in Olyv App?

- Navi Loan App Review 2025: Real or Fake? How to Apply for Loan in Navi App?

- CASHe Loan App Review 2025: Real or Fake? How to Apply for Loan in CASHe App?

- IndiaLends Loan App Review 2025: Real or Fake? How to Apply for Loan in IndiaLends App?

FAQ

Q: Is it safe to take a loan from LazyPay?

A: LazyPay maintains high security on customers information

Q: Who is eligible for LazyPay?

A: Age Must be minimum 18 Years old and Applicant must be Indian citizen

Q: Does LazyPay affect CIBIL score?

A: Yes. If you don’t pay the installment on time the cibil score get impact

Q: Is aadhaar card important to apply for a loan in LazyPay?

A: Yes

Q: What is BNPL?

A: BNPL stands for Buy Now Pay Later. It is the new feature of LazyPay Loan App