Viva Money Loan App: The Viva Money Loan App functions as an urgent source for personal loan options. The bank denies your loan application. Your bank application for a loan received denial or the bank refused your request. Do not worry because work allows you to gain money through this platform. Loan apps serve as the sole resource to assist those who cannot access funding anywhere. Through any authentic loan application portal you can initiate applications for Personal Loans and other financing options which include Home Loan, Business Loan and Education Loan.

The following article explores another loan application. This explanation may provide you with a better understanding of this loan application system. The urgency for borrowing from you motivates me to review this application. You need to understand what platform you choose to borrow money since this represents a vital detail. Manying Loan Applications without proper review will result in pain down the road for you. This article explores Viva Money Loan App Review starting right now.

What is the Viva Money App?

People can access various financial services through the digital Viva Money App platform. The internet contains Viva Money Loan App as one of its most dependable loan applications. Users rate Viva Money App very positively in the Google Play Store. The transaction records on the internet demonstrate that Viva Money App has reached 10 million downloads.

Viva Money loan app enables its users to access several financial options through its platform. People can obtain money loans through this app together with fixed plan deposits and digital gold investments and savings plans and motor insurance and credit card services from its partnering companies. The Viva Money application makes UPI transactions available as well as Performs payment and money transfer functions.

Viva Money Loan App: Technical Details

If you want to use the Viva Money Loan app, it is very important that you understand its technical aspects. Because if any app is technically strong, then such an app can be easily trusted.

| Technical Name | Viva Money Loan App |

|---|---|

| App Version | Version 15.2 |

| Developer | Viva Fintech Pvt. Ltd. |

| Organization | Viva Fintech Pvt. Ltd. |

| Total Download | 10 Million |

| App Size | 55 MB |

| App Compatibility | Iphone & Android |

| IOS Version | IOS 13 or Later |

| Category | Finance |

| Language | English |

| License | ISO 27001:2023 Certified |

| Price | Free |

Types of Products or Services Available in Viva Money App

The Viva Money loan application includes multiple financial capabilities which serve its user base. Users of this app can borrow money and contribute to fixed plan schemes while investing their funds in digital gold and savings accounts and motor insurance and credit cards available through its partnering institutions. Through its Viva Money application users can execute UPI transactions for payments and money transfer services.

- Viva Money UPI

- Personal Loan

- 24K Pure Gold Investment

- Home Loan

- Loan On Property

- Business Loan

- Credit Card

- Smart Pay

- Fixed Deposit

- Vehicle Insurance

What Types of Loans Does Viva Money App Provide?

- Personal Loan

- Home Loan

- Business Loan

- Property Loan

Features of Viva Money Loan App

- You can get a loan from ₹10,000 to ₹20,00,000

- Flexible repayment tenure features from 3 months to 6 years

- Interest rate starts from 12% per annum

- The Annual Percentage Rate (APR) for a personal loan starts from 15% to 40%

- 100% Paperless application process

- 100% Transparent

- No Hidden Charges, No Surprises

- This app offers 24K pure gold investment starting from ₹50

- Invested gold is stored in 100% secure lockers in partnership with SafeGold

- Deposits up to ₹5 Lakhs insured by DICGC

- Book FD without opening a bank account

- FD with RBI-approved Banks & NBFCs

- Fixed Deposit starts with as low as ₹500

- You can get vehicle insurance in this app

- Cashless Claims for insurance

- No Vehicle Inspection required for insurance

Is Viva Money Loan App Genuine?

Checking the genuineness of any loan app becomes vital before starting its use. The online world contains numerous loan application programs. All these apps cannot be confirmed as authentic. Reviews on the subject deliver important information thus serving as an excellent research method. Any selected fake app will lead to an unscrupulous activity.

Cautious behavior is essential when processing applications for loans. We exist to supply original reviews regarding every loan application type. The following article includes an analysis of the Viva Money Loan App based on original user reviews extracted from the Google Play Store.

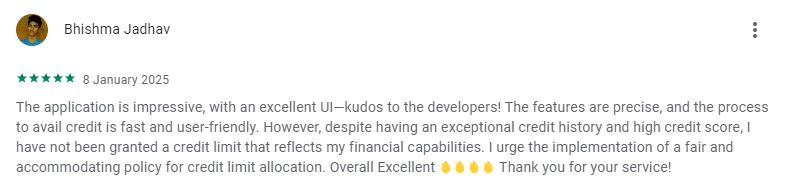

Positive Comments

- “The app is perfect, easy to use, and offers fast loan disbursal.”

- “High return rate on Gold Investment.”

- “User-friendly interface and effective in disbursing loans.”

- “Smooth and reliable performance with regular updates.”

- “Easy access to credit cards, house loans, auto loans, and personal loans up to ₹20 Lakhs.”

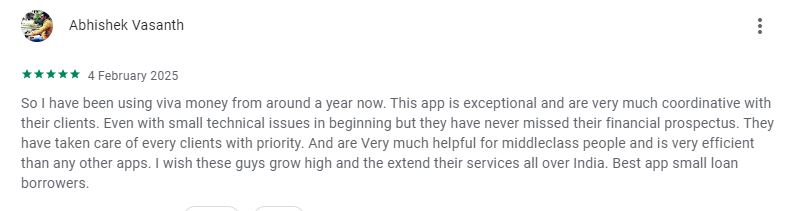

Negative Comments

- “Not satisfied with customer support.”

- “The app sometimes crashes while making payments.”

- “After repaying my last loan, I was unable to apply for a new one and was asked to wait for six months.”

- “Extremely high interest rates, processing fees, and additional charges.”

- “The app fails to display my CIBIL score

Users Review Screenshots

Final Review

The Viva Money Loan App offers maximum financial services with a focus on convenience and ease of use. While it is a legitimate platform that provides fast access to loans and investments, there are a few areas where improvement is needed, particularly regarding customer support and app stability. The high interest rates and extra fees could also be a deterrent for some users.

If you’re looking for quick loans or want to explore investment options like gold and fixed deposits, Viva Money can be a good choice. However, it’s essential to weigh the costs and potential drawbacks before making any financial decisions. As with any financial product, do your due diligence and ensure that the terms align with your personal financial goals.

Disclaimer

We don’t encourage anybody to take a loan from any kind of Non banking finance company’s loan application. Because all the loan applications have a high interest rate compared to banks. So for financial emergencies first try to contact the nearest bank and in case of high emergency time, you can rely on the RBI NBFC licenced loan app. Before using those loan applications, first visit loan application review website apploan.in for genuine review.

Important Contacts

Email Address: chat@vivamoney.in

Important Links

Viva Money Loan App Official Website – Click here

Download Viva Money App from Google Play Store – Click Here

Download Viva Money App from App Store – Click Here

Apply Personal Loan on Viva Money – Apply Here

Join Whatsapp Group – Click Here

Join Whatsapp Channel – Click here

Latest Money App Reviews

- $500 Dollar Loan: Get Instant 500 Dollar Loan Online in the USA 2025

- SmartCoin Loan App Review 2025: Real or Fake? How to Apply for Loan in SmartCoin App?

- Olyv Loan App Review 2025: Real or Fake? How to Apply for Loan in Olyv App?

- Navi Loan App Review 2025: Real or Fake? How to Apply for Loan in Navi App?

- CASHe Loan App Review 2025: Real or Fake? How to Apply for Loan in CASHe App?

- IndiaLends Loan App Review 2025: Real or Fake? How to Apply for Loan in IndiaLends App?

FAQ

Q: Is VivaMoney Loan App working in Karnataka?

A: Viva Money Loan App recently started working in the Karnataka region also

Q: What is the minimum Loan amount you can get from Viva Money Loan App?

A: 5000 Rs

Q: Is Viva Money RBI approved?

A: Viva Money loan app is partnered with Fincfriends Private Limited, which is registered under RBI- NBFC Licence.

Q: What are the repayment term charges for 10 Months in the Viva Money Loan App?

A: 999 Rs

Q: What are the required documents to apply for personal loan in the Viva Money?

A: Pan Card, Adhaar Card, Selfi or Photographs