TrueBalance Loan App Review: Not all loan apps on the internet are genuine. Similarly, not all loan apps are fake. If you are going to use a loan app, first read the reviews of such loan apps and then get a loan. In this article, we are going to give a brief description and review of another new loan app, TrueBalance Loan App. Here you will get the special features of TrueBalance Loan App, loan type, how to apply for a loan, and other necessary information.

Here we will provide information about what TrueBalance is and how it works. We have provided genuine reviews of many such loan applications on our blog apploan. You can read and share your opinion. Continue reading about TrueBalance Loan App Review.

What is a TrueBalance Loan App?

True Balance app is a finance company that provides instant personal loans and is operated by Balancehero India Private Limited, an Korean-based financial company. It was established in July 2014. TrueBalance app not only provides loan facility but also UPI system is available. TrueBalance loan app provides easy personal loans from Rs. 1000 to Rs. 200000. TrueBalance application is available for you on Google Play Store.

TrueBalance is not just an app but a company with more than 200 employees. TrueBalance loan app is the most recommended app on the internet. Trubalance app has more than 5 Crore downloads and 30 Lakh of reviews. You can identify the app whether it is trustworthy or not by checking out all the reviews on the internet.

Features Of True Balance Loan App

- You will get Quick Personal Loan here

- You can apply for Cash Loan here

- You can apply for Level Up Loan here

- True Balance assures 100% safe and secure platform

- This app is 100% Digital

- Truebalance app provides 24*7 access to loans

- People can get loan from ₹1,000 to ₹2,00,000 (Disbursal Amount)

- You will get Flexible Tenure repayment period of 6 to 12 months

- There will be Low Processing Fees in Affordable costs

- Direct loan disbursal to your bank account

Different Services Available on True Balance Loan App

TrueBalance Loan App is currently one of the most popular and trusted loan apps in India. It also has the highest star rating. Some of the special services provided by TrueBalance Loan App are as follows.

- Quick Personal Loan

- UPI Service

- Credit Loan

- Cash Loan

- Level Up Loan

- Easy & Quick Recharge and Bill Payments

- Digital wallet

- Utility Payments

- E-Commerce

- Insurance

What type of Bill payments I can do on TrueBalance Loan App

- Electricity Bill

- Gas Bill

- Broadband Bill

- Water Bill

- Recharge

- DTH Top Ups

Lending Partner for True Balance Loan App

- True Credits Pvt. Ltd.

- InCred Financial Services Limited

- Grow Money Capital Pvt. Ltd.

- Muthoot Finance Ltd.

- Vivriti Capital Limited

- Northern Arc Capital Limited

- Lendbox (Transactree Technologies Pvt. Ltd.)

- Oxyzo Financial Services Limited

Who can apply for personal Loan in TrueBalance App

Everyone can apply for a personal loan in the True Balance Loan app. But To get a loan on TrueBalance Loan App, you need to meet some eligibility criteria. You need to give assurance to the bank about your source of repayment of the loan you get.

- Must be Indian

- Applicant should have a fixed salary or stable income source

- Your age must be minimum 18 and maximum 50 years

- Applicant must have valid Phone Number, Email Address, Pan Card and Aadhar Card

How to apply for a personal loan in a True Balance Loan App?

Applying for a personal loan on True Balance is just a five minute process. People can apply for the loan through TrueBalance website or mobile application. If you want to apply for a loan from TrueBalance mobile app, you must install it. Once you are installed, you need to sign up with your details and complete your KYC. Later you can apply for a loan.

- Download and install the True Balance Application from Google Play store or app store

- Sign up or sign in with your basic details

- Complete your KYC by providing necessary documents

- Provide salary details

- Provide Bank details

- Select loan amount

- Chose the tenure and Repayment option

- Submit your loan application.

Is the Truebalance Loan app genuine or a fraudulent app?

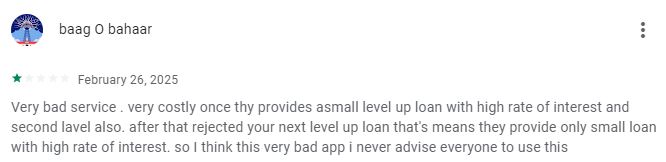

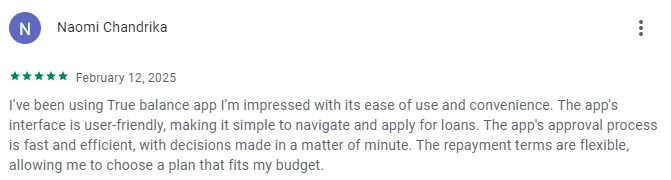

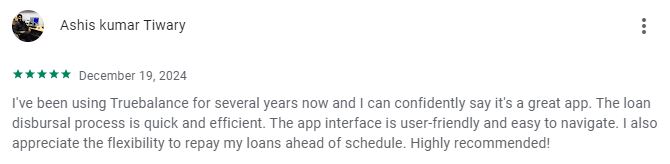

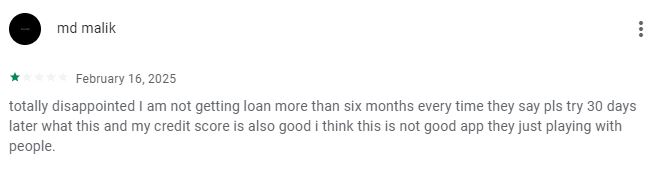

There are many loan applications online. But not all are original. But only Truebalance Loan app is genuine as per our analysis. Because till now no fraud case has been registered on Truebalance Loan app. Also more than millions of people have given their feedback using this loan app. We have put some of them in the screenshot below. It is very important to read such review screenshot and article before using a loan app. This will help you know how genuine such a loan app is.

In some cases, there is a possibility that other fraudsters will call and make a scam to the customers in the name of such loan apps. If you believe in those kinds of applications and borrow the loan amount, then you will be trapped easily after providing important documents. So always think twice before using a loan application. You just need to check the loan application review on our blog apploan.in. and reviews provided in the blog.

These below review screenshots will help you to understand about the loan application. These reviews were collected from the Google Play Store provided by the real users.

Important Contacts

Contact Number: (0120)-4001028

Email Address: cs@balancehero.com

Address: Gurugram, Haryana

Important Links

TrueBalance Loan App Official Website: Click Here

Download TrueBalance from Google Play Store: Click Here

Download TrueBalance from App Store: Click Here

Apply for Personal Loan in TrueBalance: Click Here

Join Whatsapp group: Click Here

Join Whatsapp Channel: Click Here

Disclaimer

Money is necessary for everyone but how we earn it is important. When times are tough, we need money. Such loan apps come forward to lend us money when no one is ready to give us money. These loan apps provide you with a loan according to your eligibility. But most of these apps do not work for you and they rob people in the form of interest rates and other fees. So, think ten times before taking a loan from such applications. Sometimes, even the documents you provide are not secure with them. There is a high chance of information leakage. Always go through apploan.in blog for genuine review about the loan application.

FAQ

Q: Is the TrueBalance Loan App fake or real?

A: TrueBalance Loan App is not a fake app. It is an established loan application which provides personal loan facilities.

Q: How to contact the TrueBalance Loan App customer support team?

A: Customers can contact the True Balance Loan App customer support team through phone number (0120)-4001028 and Email Address cs@balancehero.com. People also raise their request or ticket using the ‘’Raise Request’’ option.

Q: Who is the Founder of True Balance Loan App

A: Charlie Lee is the Founder and CEO of the TrueBalance Loan App

Q: Is the True Balance loan App RBI approved?

A: Yes.

Q: Who is eligible for a True Balance loan?

A: The person who has a minimum salary of ₹20,000 and self-employed individuals with an ITR of ₹240,000. And their age must be under 18 and 50

Q: How to apply for a personal loan in the True Balance App?

A: To apply for a personal loan in the True Balance Loan app, you must download the loan application from the google play store.

Mujhe paison ki avashyakta hai

kis taraha ki pension? aap ki job ki? hum pension ki related artice daalne ki koshish karthehe..

No matter if some one searches for his vital thing, therefore he/she wants to

be available that in detail, thus that thing is maintained over here.