KreditBee Loan App Review 2025 | Genuine or Fake? How to Apply & Eligibility

KreditBee Loan App Review: Are you fed up of searching for real or genuine loan providing app on the internet?. Then you are in the right place. I am not saying you chose the right loan app to borrow the loan, but here we are providing a genuine review about the loan application in this blog. In this blog, we are providing KreditBee Loan App Review 2025. Also you can find how to apply for a loan in the KreditBee Loan App. What is the procedure to apply for a loan in the KreditBee Loan App, easy steps to get loan in KreditBee. So Read the full KreditBee Loan App Review article for complete review.

Before moving to more information about the KreditBee Loan App Review, we would like to warn about the fraudulent loan apps working towards scamming the customers, especially the people who are in need of money in the present days. We request please read and understand carefully about the loan applications and their existence before applying for a loan. We only provide information regarding loan apps and their features and also about the trustability of those loan apps through our reviews. We are not responsible for your loss and gain at all.

What Is a KreditBee Loan App?

KreditBee is one of India’s leading digital lending platforms, offering fast personal loans between ₹6,000 and ₹10,00,000 with flexible repayment options. The app works with RBI-registered NBFCs, ensuring legal compliance while providing a seamless, end-to-end online loan experience from application to disbursal in just minutes. KreditBee Loan App Review will give you the complete structure of KreditBee Loan App.

Features of KreditBee Loan App

- Wide Loan Range: Borrow from ₹6,000 up to ₹10 lakh

- Interest Rates: Competitive rates between 12% to 28.5% p.a.

- Tenure Flexibility: Pay back between 6 to 60 months, adapting to your budget.

- APR Guidance: Cleary displayed APR between 17% and 50%, including fees.

- Quick Disbursal: Get funds within 10 minutes of approval.

- Minimal Paperwork: Entire process is online, no bank visits or physical documents required.

- Extras Included: Explore UPI payments, gold purchase, and more inside the app.

Types of Loan Available on KreditBee Loan App

Personal Loan:

KreditBee Loan App offers easy personal loans for salaried and self-employed people with flexible repayment terms starting with 6 months to 60 months for a loan amount of ₹6,000 to ₹10,00,000. KreditBee Loan App Review.

Business Loan:

KreditBee Loan App offers Business loans from ₹6,000 to ₹5,00,000 with flexible repayment terms of 6 to 48 months.

Two-wheeler Loan:

The people who want to buy a two wheeler vehicle can apply for a loan in KreditBee Loan App. They can get a loan up to ₹5,00,000 with flexible repayment terms of 6 to 60 months.

Loan Against Property:

KreditBee Loan App provides a standard loan against property. People can use their property as collateral for up to ₹1 Crore. Repay over a period of up to 20 years with lower interest rates from 12%. This loan facility available in major cities across South India.

KreditBee 24K Gold:

Buy or sell 24K Gold online easily using KreditBee Loan App.

Step-by-Step Application Process KreditBee Loan

- Download the KreditBee app from Google Play or App Store.

- Register using your mobile number or social account.

- Submit basic data, upload your PAN, Aadhaar, income statements, and a selfie.

- Pick your preferred loan amount and tenure.

- Review interest, EMI, and APR details clearly displayed.

- Confirm and sign digitally.

- Loan disbursement happens quickly—right into your bank.

Who Is Eligible for KreditBee Loan?

- Indian residents aged between 21 and 60 years.

- Minimum monthly income must be around ₹10,000–₹25,000, depending on the loan type.

- Salaried or self-employed people can apply for a loan in KreditBee.

- Must submit valid PAN & address proof.

What Documents Are Required to apply for a KreditBee Loan?

- PAN Card

- Photo ID Proof (Aadhaar, Passport, Voter ID)

- Income proof (Salary slip or bank statement)

- Selfie for verification

- Address proof if required

- eNACH mandate for EMI auto-debts

Is KreditBee Loan App Legit or a Scam?

KreditBee is fully legitimate. It partners with recognized RBI-approved NBFCs such as Krazybee, InCred, Piramal Finance, and Tata Capital. The platform operates transparently and is regulated under Indian financial laws. According to the Google Play Store, many customers have given positive and negative feedback equally. And the rating is also average. Most of them have shared feedback about technical issues. But there is no information about any fraud. No Feedback about any scam. So this app is recommended. KreditBee Loan App Review.

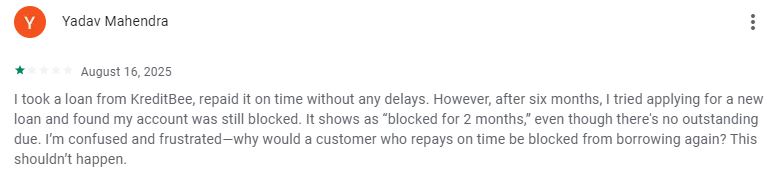

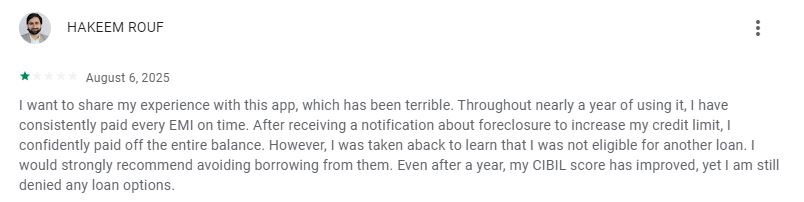

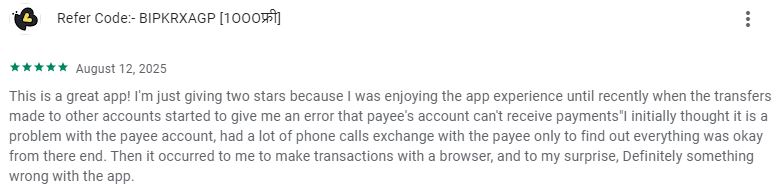

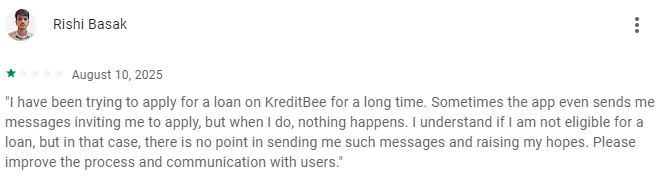

For your more confirmation and understanding we will share the real customer feedback screenshot taken from google play store. So you can get to know what is the issue people have shared on feedback. It is very helpful for you on this KreditBee Loan App Review article.

Real Customer FeedBack Screenshots

Common User Complaints about KreditBee Loan App

KreditBee Loan App Review: While many users appreciate the ease, a few issues have surfaced:

- Higher interest rates: particularly for users with low credit scores.

- Foreclosure charges: typically 4% of the outstanding principal plus GST for early loan repayment.

- Late payment penalties: EMI bounce charges of ₹500 or 4% of overdue principal, plus daily penalties up to 36% p.a.

- Blocking Account: Loan accounts get closed even after the repayment of the loan genuinely or regularly.

Can You Foreclose Your KreditBee Loan?

KreditBee Loan App Review: Yes, you can prepay or foreclose your loan—but expect a fee of around 4% + GST on the outstanding amount. It’s important to check these details in your Key Facts Statement before proceeding.

Pros and Cons of KreditBee Loan App

Pros

- Super-fast approval and disbursal

- Wide loan amounts and flexible repayment plans

- No collateral or branch visits

- Transparent fees and regulated operations

Cons

- APR can climb up to 50% if not careful

- Foreclosure and late repayment fees may be steep

- Requires minimum income and document readiness

- Technical Issues

Should You Choose KreditBee for Quick Loan?

If you need an urgent personal loan and want it delivered digitally, KreditBee is an excellent choice, clean, fast, and reliable. Just make sure you monitor fees carefully, manage repayment well, and understand your EMI obligations to avoid penalties.

Here We would like to warn about the fraudulent loan apps working towards scamming the customers, especially the people who are in need of money in the present days. We request please read and understand carefully about the loan applications and their existence before applying for a loan. We only provide information regarding loan apps and their features and also about the trustability of those loan apps through our reviews. We are not responsible for your loss and gain at all. KreditBee Loan App Review.

.

Tags to reach this article

KreditBee loan app review 2025, Is KreditBee legit, KreditBee interest rates, How to apply loan KreditBee app, KreditBee eligibility criteria, KreditBee customer care, KreditBee foreclosure charges, KreditBee Loan App Review. KreditBee Loan App details, Loan In KreditBee Loan App, Get loan from KreditBee Loan App.

Important Contacts

Mobile Number: 08044292200. 08068534522

Customer Number: 080-4429-2200 / 080-6853-4522

Email Address: help@kreditbee.in

Postal Address: KreditBee, 4th Floor, Anjaneya Techno Park, No. 147, HAL Old Airport Road, ISRO Colony, Kodihalli, Bangalore, Karnataka, India

Important Links

Official Website of KreditBee Loan App: Click Here

Download KreditBee Loan App From Google Play Store: Click Here

Download KreditBee Loan App From App Store: Click Here

Earn Money Online Free:Click Here

Read Also

- $500 Dollar Loan: Get Instant 500 Dollar Loan Online in the USA 2025

- SmartCoin Loan App Review 2025: Real or Fake? How to Apply for Loan in SmartCoin App?

- Olyv Loan App Review 2025: Real or Fake? How to Apply for Loan in Olyv App?

- Navi Loan App Review 2025: Real or Fake? How to Apply for Loan in Navi App?

- CASHe Loan App Review 2025: Real or Fake? How to Apply for Loan in CASHe App?

- IndiaLends Loan App Review 2025: Real or Fake? How to Apply for Loan in IndiaLends App?

FAQs

Q: Who is eligible for KreditBee Loan?

A: Any Indian citizen aged 21–50 years with Aadhaar, PAN, and an active bank account.

Q: How do I close my KreditBee Loan?

A: Loans can be closed through EMI repayment in the app or by choosing foreclosure (charges may apply).

Q: What is the interest rate on KreditBee Loans?

A: Interest rates vary between 15% and 30% per annum, depending on credit history.

Q: What is KreditBee’s customer care number?

A: The support number is 080-44292200.

Q: What is the age limit to apply?

A: Minimum age is 21 years, and the maximum age is 50 years.

Q. What is the interest rate for personal loans?

A: KreditBee personal loans generally start at 15% per annum, subject to borrower eligibility.

2 thoughts on “KreditBee Loan App Review 2025: Real or Fake? How to Apply for Loan in KreditBee?”