ZayZoon App Review 2025: Discover how ZayZoon helps employees access earned wages before payday with its pay on demand feature. Learn how the app works, fees, features, pros, cons, and what companies use it. A complete guide to earned wage access for U.S. workers seeking wages early.

If you’ve ever run short of cash before payday, you’re not alone. Millions of Americans live paycheck to paycheck, often relying on high-interest loans or overdrafts to bridge the gap. That’s where ZayZoon comes in a “pay on demand” app that gives employees access to earned wages before payday. Let’s dive into what the ZayZoon app is, how it works, its features, and whether it’s right for you. ZayZoon App Review 2025.

ZayZoon app download, ZayZoon Login, ZayZoon customer service, ZayZoon reviews, What companies use ZayZoon, How does ZayZoon work, ZayZoon customer service number, ZayZoon repayment, ZayZoon App Review 2025, ZayZoon App Review 2025 details.

What Is ZayZoon App?

ZayZoon App Review 2025: ZayZoon is a financial wellness platform that provides Earned Wage Access (EWA), also known as Wages On-Demand. Instead of waiting for the next paycheck, employees can instantly withdraw a portion of the money they’ve already earned. Unlike payday loans, this isn’t borrowed money. it’s simply your wages, made available early. ZayZoon App Review 2025.

For employers, ZayZoon is promoted as a no-cost benefit that integrates with payroll systems and helps improve employee satisfaction, reduce turnover, and attract talent. ZayZoon App Review 2025 will give you complete information regarding the app. ZayZoon App Review 2025.

How to Use the ZayZoon App

Getting started with ZayZoon is simple, but your employer must be partnered with the service. Here’s how it works:

- Check Employer Eligibility – Confirm your company offers ZayZoon as part of its benefits.

- Create an Account – Sign up on the ZayZoon app (iOS/Android) or web portal.

- View Available Earnings – The app shows how much of your earned wages you can access.

- Request a Payout – Choose how much to withdraw (within limits) and where to send it.

- Get Paid Instantly – Funds can be transferred to a bank account, prepaid card, or even through instant gift cards.

- Automatic Repayment – On payday, the advance is deducted from your paycheck automatically.

How to Get Money from ZayZoon

With ZayZoon, you can typically access up to 50% of your earned wages in a pay cycle, subject to daily limits (often up to $200). The process works 24/7, so you can withdraw money even on weekends or holidays. ZayZoon App Review 2025.

- Direct Deposit – Sent to your bank (small flat fee, usually up to $5).

- Prepaid Card – Load your ZayZoon card for spending.

- Gift Cards – Convert wages into instant gift cards, sometimes with added bonuses.

What Is the Use of ZayZoon?

The purpose of ZayZoon is to give workers financial flexibility and reduce stress caused by unexpected expenses. Instead of turning to payday lenders, overdrafts, or credit cards, employees can cover urgent bills with their own earned money. ZayZoon App Review 2025.

For employers, the service improves retention and morale. According to ZayZoon, nearly 80% of workers would prefer a job that offers on-demand pay.

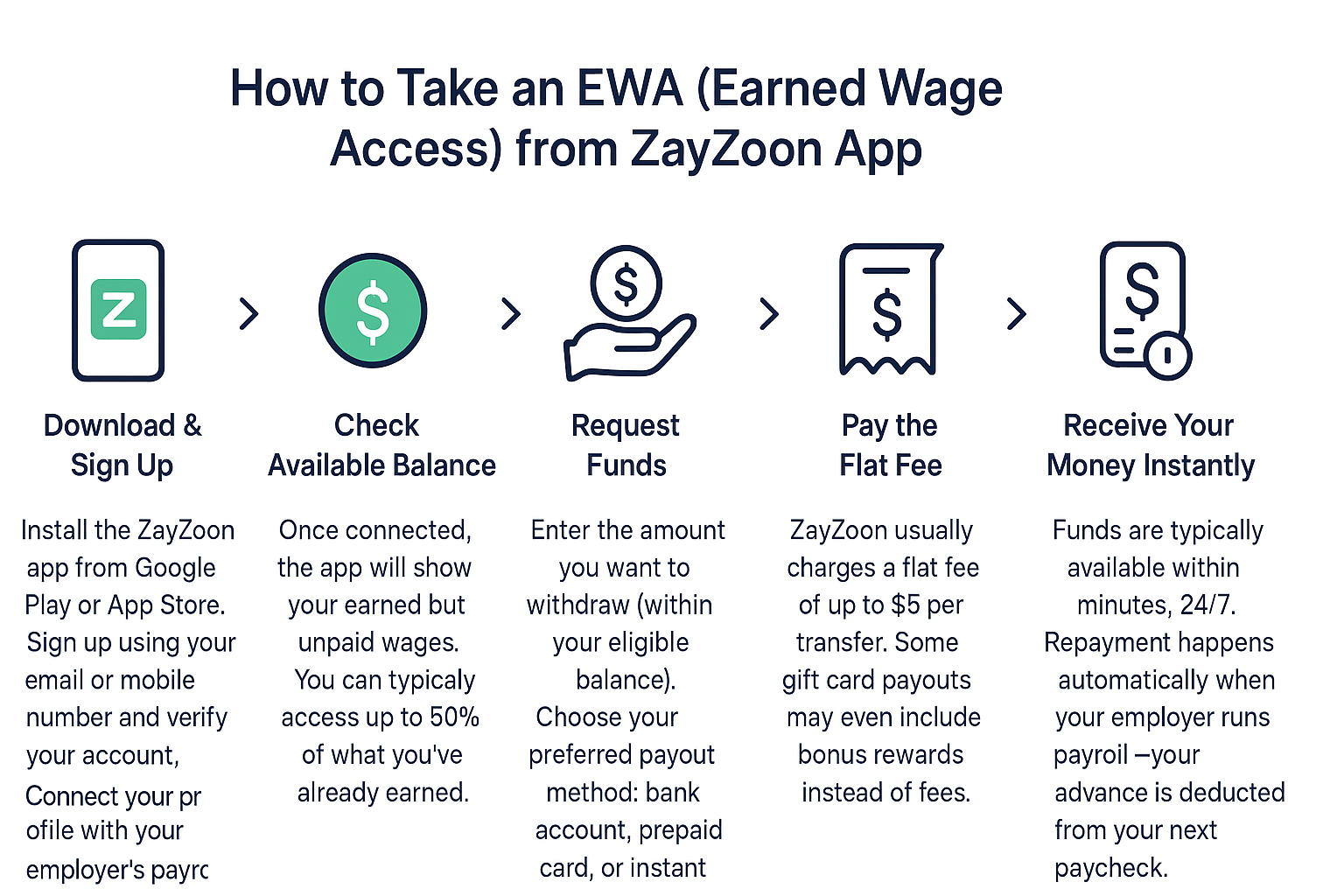

How to Take an EWA (Earned Wage Access) from ZayZoon App

- Download & Sign Up

- Install the ZayZoon app from Google Play or App Store.

- Sign up using your email or mobile number and verify your account.

- Connect your profile with your employer’s payroll system (only possible if your employer has partnered with ZayZoon).

- Check Available Balance

- Once connected, the app will show your earned but unpaid wages.

- You can typically access up to 50% of what you’ve already earned.

- Request Funds

- Enter the amount you want to withdraw (within your eligible balance).

- Choose your preferred payout method: bank account, prepaid card, or instant gift card.

- Pay the Flat Fee

- ZayZoon usually charges a flat fee of up to $5 per transfer. Some gift card payouts may even include bonus rewards instead of fees.

- Receive Your Money Instantly

- Funds are typically available within minutes, 24/7.

- Repayment happens automatically when your employer runs payroll—your advance is deducted from your next paycheck.

Features of the ZayZoon App

The ZayZoon platform isn’t just about early pay. Here are its standout features:

- Wages On-Demand – Access earned wages anytime.

- Multiple Payout Options – Bank account, prepaid card, or instant gift card.

- Flat Transaction Fee – Transparent, no interest charges.

- Automatic Repayment – No need to track repayments.

- Financial Wellness Tools – Budgeting tips, low-balance alerts, and money management guidance.

- 24/7 Availability – Request advances anytime, day or night.

- Secure Payroll Integration – Works with 130+ payroll providers without changing company systems.

ZayZoon – Pay on Demand Explained

ZayZoon App Review 2025: ZayZoon’s “Pay on Demand” model allows employees to access their own earned income before payday. It’s not a loan, there’s no credit check, and repayment is automatic through payroll. By charging a flat fee instead of interest, ZayZoon positions itself as a safer alternative to payday loans or overdrafts. ZayZoon App Review 2025.

What Companies Use ZayZoon?

ZayZoon partners with employers across industries including:

- Healthcare & Senior Care

- Hospitality & Restaurants (e.g., Panera Bread)

- Retail & Grocery

- Call Centers & Manufacturing

It integrates with major payroll providers like ADP, Execupay, and Time and Pay, making it accessible to thousands of U.S. businesses.

Pros and Cons of ZayZoon

Pros

- Access earned wages instantly

- No debt or interest charges

- Useful budgeting and financial wellness tools

- Available 24/7, even on weekends

- Helps reduce employee financial stress

Cons

- Flat transaction fee (up to $5) can add up with frequent use

- Only part of wages is available (typically 50%)

- Some users report app glitches or delays

- May encourage over-reliance on early pay

Is ZayZoon Right for You?

ZayZoon is a legit earned wage access app that can be a lifesaver when unexpected expenses pop up before payday. For employees, it offers flexibility and peace of mind. For employers, it’s a low-cost benefit that boosts retention and recruitment.

That said, frequent use may eat into your paycheck due to transaction fees, so it’s best used as an occasional financial safety net rather than a regular habit.

Important links for ZayZoon App Review 2025

ZayZoon app Official Website: Click Here

Download ZayZoon App from Google Play Store: Click here

Download ZayZoon App iOS App Store: Click Here

Conclusion: ZayZoon App Review 2025

If you’re looking for a safe, quick way to get your wages before salary in the U.S., ZayZoon is worth considering. It bridges the gap between paychecks, helps reduce reliance on high-cost credit, and empowers employees with financial flexibility.

Bottom line: ZayZoon is not free money — it’s your money, made available when you need it most. Used wisely, it can be an excellent financial tool.

FAQ: ZayZoon App Review 2025

Q: Is ZayZoon a loan?

A: No. ZayZoon is not a loan or credit product. It simply lets you access wages you’ve already earned before payday. There’s no interest, and repayment happens automatically on your next paycheck.

Q: How much money can I get from ZayZoon?

A: Most employees can access up to 50% of their earned wages, with daily caps (often around $200). Exact limits depend on your employer’s setup and payroll system.

Q: Does ZayZoon charge fees?

A: Yes, ZayZoon charges a flat transaction fee (commonly up to $5) when transferring funds to a bank account. Some payout methods, like instant gift cards, may be free or come with bonus rewards.

Q: Who can use ZayZoon?

A: Only employees whose employers have partnered with ZayZoon can use the app. If your company’s payroll system integrates with ZayZoon, you’ll be able to sign up and access earned wages.

Q: How fast does ZayZoon pay out?

A: ZayZoon processes requests instantly, 24/7. Depending on your payout method, money can arrive within minutes to your bank account, prepaid card, or as an instant gift card.

Q: What companies use ZayZoon?

A: ZayZoon is offered by employers in industries such as healthcare, retail, hospitality, restaurants, call centers, and manufacturing. It also integrates with popular payroll systems like ADP and Execupay.

Q: Is ZayZoon safe to use?

A: Yes. ZayZoon uses payroll integration and secure data practices (SOC 2 Type II compliance). Your employer does not pay for the service, and repayment is handled automatically through payroll deductions.

Q: Can using ZayZoon hurt my credit score?

A: No. Since ZayZoon is not a loan and does not involve credit reporting, it will not impact your credit score.

Q: Is ZayZoon free to use?

A: Yes. It is Free to use

Q: How long does ZayZoon take to approve?

A: Within an hour

2 thoughts on “ZayZoon App Review 2025: Earned Wage Access & Wages Before Salary”