Best loan EMI calculator in India: Managing a loan smartly starts with understanding your EMI. Whether you are planning a home loan, personal loan, car loan, or education loan, using the best loan EMI calculator in India helps you plan your finances properly. It allows you to know your monthly payment, total interest, and repayment amount before applying for a loan.Best loan EMI calculator in India.

In this article, you will learn:

- What is a loan EMI calculator

- Benefits of using EMI calculators

- Best loan EMI calculators in India

- How to choose the best one

- Tips to reduce your EMI

What is a Loan EMI Calculator?

A Loan EMI Calculator is an online tool that helps you calculate your Equated Monthly Installment (EMI) based on:

- Loan Amount

- Interest Rate

- Loan Tenure

Best loan EMI calculator in India. EMI is the fixed monthly payment you make to repay your loan.

EMI Formula:

EMI = P × R × (1+R)^N / [(1+R)^N – 1]

Where:

- P = Loan amount

- R = Monthly interest rate

- N = Number of months

Manual calculation is difficult, so EMI calculators make it instant and easy. Best loan EMI calculator in India.

Why EMI Calculator is Important

Using an EMI calculator gives many benefits:

1. Financial Planning

You can check whether the EMI fits your monthly budget.

2. Compare Loans

You can compare loans from different banks like:

- State Bank of India

- HDFC Bank

- ICICI Bank

- Axis Bank

3. Saves Time

Instant results in seconds.

4. Accurate Calculation

No human error.

Best Loan EMI Calculators in India

Here are the top EMI calculators in India:

1. CareerLive Loan EMI Calculator

If you have a job website or finance website, your own EMI calculator is the best option.

Features:

- Simple and fast

- Mobile friendly

- Works for all loans

- Free to use

Best for:

- Personal loan

- Home loan

- Bike loan

- Education loan

2. BankBazaar EMI Calculator

BankBazaar offers one of the most popular EMI calculators.

Features:

- Accurate results

- Easy interface

- Shows amortization schedule

Best for comparing multiple banks.

3. Paisabazaar EMI Calculator

Paisabazaar is another trusted platform.

Features:

- Free tool

- Fast calculation

- Shows total interest

Good for personal loan planning.

4. HDFC Bank EMI Calculator

HDFC Bank offers calculators for:

- Home loan

- Car loan

- Personal loan

Trusted and accurate.

5. State Bank of India EMI Calculator

SBI provides official calculators for customers.

Good for government bank loan planning.

Types of EMI Calculators

Different loans need different calculators.

Home Loan EMI Calculator

For property purchase.

Loan amount: ₹10 lakh to ₹1 crore+

Tenure: up to 30 years

Personal Loan EMI Calculator

Loan amount: ₹50,000 to ₹40 lakh

Tenure: 1 to 5 years

Car Loan EMI Calculator

Loan amount: ₹1 lakh to ₹20 lakh

Tenure: 3 to 7 years

Education Loan EMI Calculator

For student loan planning.

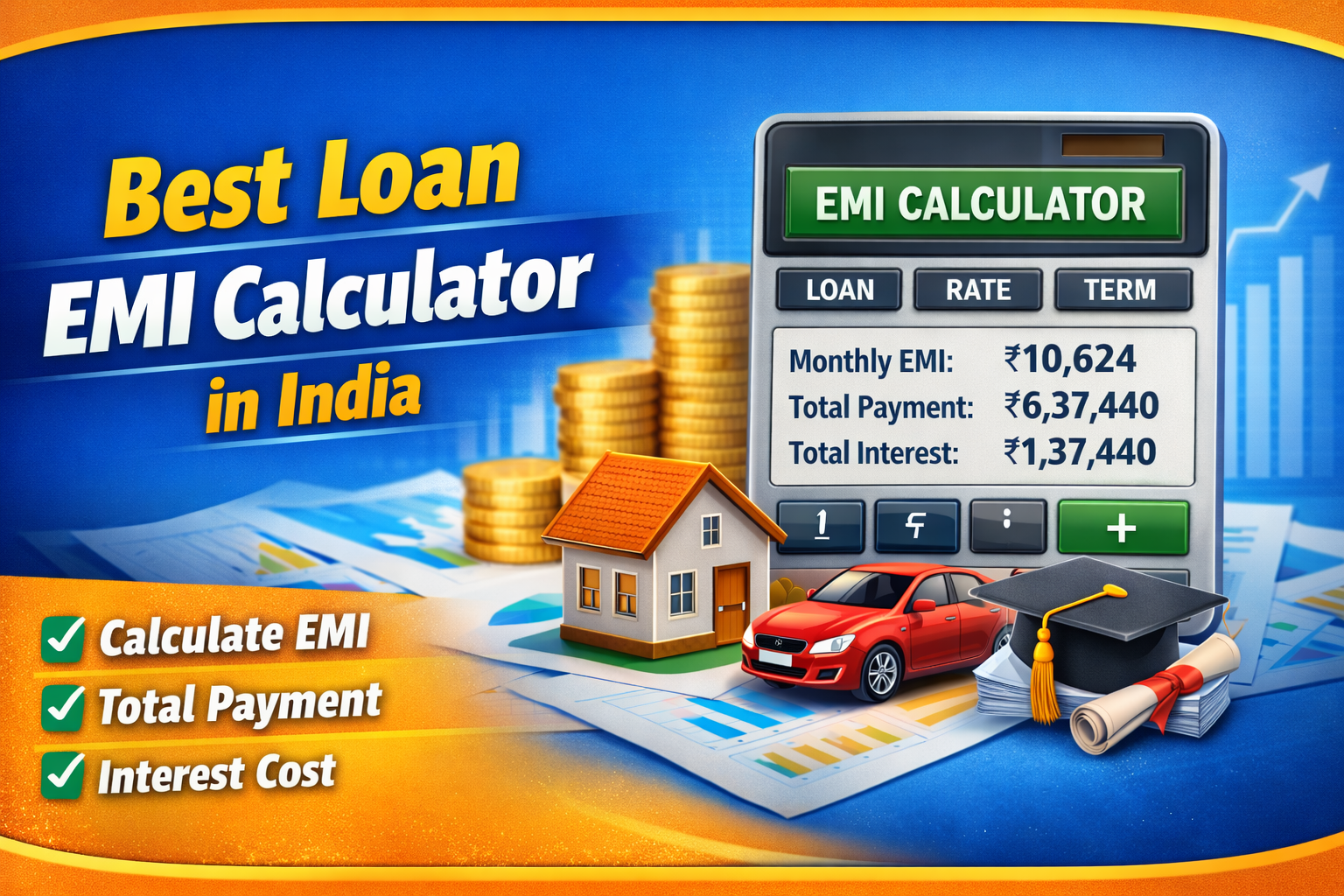

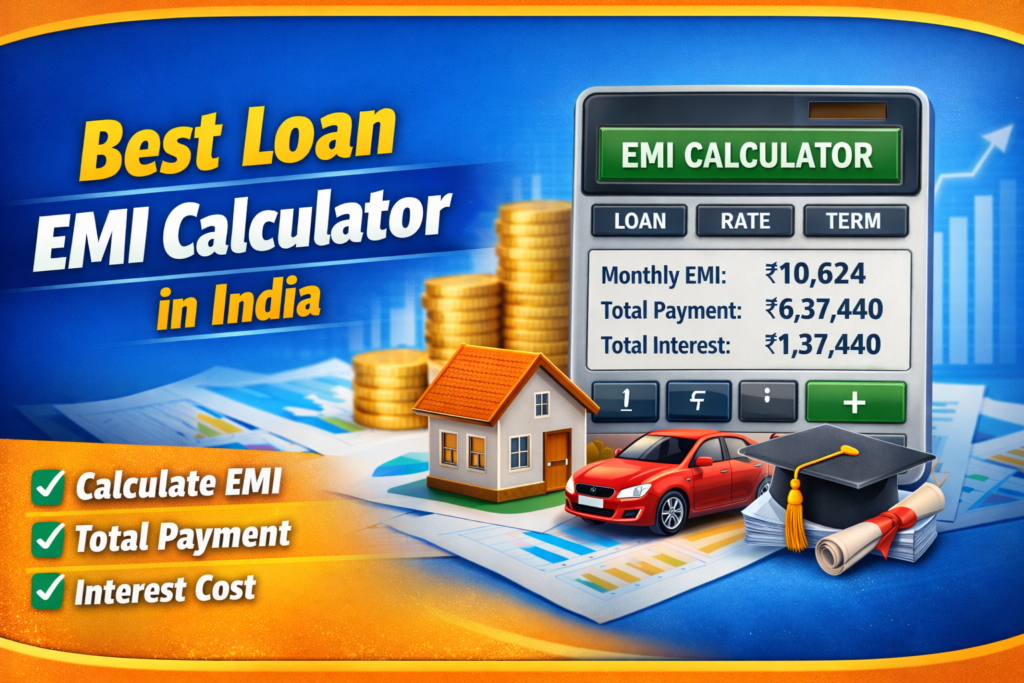

Example EMI Calculation

Example:

Loan Amount: ₹5,00,000

Interest Rate: 10%

Tenure: 5 years

Result:

EMI: ₹10,624

Total Payment: ₹6,37,440

Interest: ₹1,37,440

Benefits of Using Best EMI Calculator

Know EMI Before Taking Loan

No surprises later.

Choose Best Tenure

Long tenure = Low EMI

Short tenure = Less interest

Budget Planning

Helps manage expenses.

How to Choose Best EMI Calculator

Choose calculator with:

- Fast result

- Accurate calculation

- Mobile friendly

- Easy interface

Avoid complicated calculators.

Tips to Reduce Loan EMI

You can reduce EMI by:

1. Increase Down Payment

Less loan = Less EMI

2. Choose Longer Tenure

EMI becomes smaller

3. Compare Interest Rates

Different banks offer different rates.

As regulated by Reserve Bank of India, interest rates vary.

Who Should Use EMI Calculator

EMI calculator is useful for:

- Job holders

- Students

- Business owners

- Home buyers

Everyone taking loan.

Why EMI Calculator is Must in 2026

Loan demand is increasing in India.

Before taking loan, EMI calculator helps you:

- Avoid financial stress

- Select best loan

- Plan repayment

Conclusion

The best loan EMI calculator in India is an essential tool for smart financial planning. It helps you know your EMI, interest, and repayment amount instantly. Best loan EMI calculator in India.

Whether you use CareerLive, BankBazaar, Paisabazaar, or bank calculators, EMI calculator makes loan planning easy and safe.

Always calculate EMI before applying for a loan.

Loan EMI Calculator