Capital Now Loan App Review 2025 | Features, Eligibility, Pros & Cons

Capital Now Loan App Review: Here we come up with another trending loan app where you can take advantage of it called Capital Now Loan App. Before using this loan app just read this article fully, because we have provided Capital Now Loan App Review in this blog. We have given all the possible points which can make you understand how Capital Now Loan App performance is. We never say use the app directly, nor we promote any loan application. We just provide detailed reviews about such loan apps. capital now loan app review.

In this blog you will find key features of Capital Now Loan App, eligibility criteria to apply for loan in this app, required documents to apply for loan, repayment option, pros and cons, real customer reviews, real complaints, final thought, important links and contacts, Capital Now Loan App real or scam, Capital Now Loan App Review and frequently asked question about the Capital Now Loan App.

Capital Now loan app review 2025, Capital Now instant loan, Is Capital Now app safe, Capital Now loan eligibility, Capital Now interest rates, Capital Now NBFC partners, Capital Now personal loan review, Capital Now foreclosure charges, Capital Now Loan App Review.

Before moving to more information about the Capital Now Loan App Review, we would like to warn about the fraudulent loan apps working towards scamming the customers, especially the people who are in need of money in the present days. We request please read and understand carefully about the loan applications and their existence before applying for a loan. We only provide information regarding loan apps and their features and also about the trustability of those loan apps through our reviews. We are not responsible for your loss and gain at all. capital now loan app review.

What is the Capital Now Loan App?

If you’re a salaried professional looking for a quick loan without mountains of paperwork, Capital Now Loan App might catch your eye. Backed by Easy Platform Services, this app provides short-term personal loans, lines of credit, bill payment services, and even loans against mutual funds.

The big attraction? You can borrow up to ₹1.5 lakh with a fully online process and get the money in your bank account within minutes. Capital Now Loan App Review.

Key Features Of Capital Now Loan app

- Loan Limit: Up to ₹1,50,000

- Eligibility Check: Instant with e-KYC and AI-based approvals

- Disbursal Speed: Money often credited within 10 minutes

- Loan Types: Personal loans, two-wheeler loans, credit line, mutual fund-backed loans

- Interest Rate: APR between 24% and 36% annually

- Processing Fee: 2–6% + GST

- Foreclosure: No prepayment penalty (a big plus)

- Extra Perks: Bill payments, recharges, and referral rewards

- Fast & Easy: No physical documents, no branch visits.

- Transparency: Fees and charges are shown upfront.

- Flexibility: Choose from different EMI plans.

- Safe & Legal: Partners with RBI-registered NBFCs like Anu Colonisers and Goldline Finance.

Eligibility Criteria to apply for Loan in Capital Now

- Age: 21 years or above

- Employment: Only salaried professionals

- Income: Minimum ₹22,000 per month net salary

- Documents: Aadhaar, PAN, salary slips, and bank statement

Types of Loans in Capital Now Loan App

- Instant Personal Loan

- Instant Two-Wheeler Loans

- Loan Against Mutual Funds

Application Process to apply for loan

- You need to Download the Capital Now Loan app from Google Play or App Store using below given download link

- Sign up to the loan app with your valid Gmail, Facebook, or LinkedIn account

- Fill in your details and complete the KYC

- Now you need to Select the loan type.

- Select the loan amount which you required

- Confirm your EMI plan

- Now complete your E-sign and submit your application

- Once you done all the procedure, loan amount will be processed immediately and transferred directly to your bank account

Common Issues Reported about Capital Now

- Unwanted notifications or OTPs even when not applying for a loan

- App glitches during peak hours

- Late repayment penalties (though clearly mentioned in terms)

- Reported some unusual behavior against loan defaulters.

- Delayed Application process while applying for loan

Foreclosure Policy

One of the strongest benefits is zero foreclosure charges. If you can repay your loan early, you save on interest without any penalty. Capital Now Loan App Review.

Is Capital Now Loan App Safe?

The app follows RBI guidelines and works with registered NBFC partners. It also uses 256-bit SSL encryption to keep your data secure. That said, always check loan terms carefully and avoid over-borrowing. Though some negative opinions have registered on google play store. We will not say it is safe to use nor unsafe. We just provided as many as possible reviews about the Capital Now Loan App. It is up to you whether to use it or not.

Facing technical issues is common with all the loan apps. But it is very important that any loan app follows RBI guidelines on their services. We strongly suggest that if you are really in need of money for an emergency purpose then only go to such loan apps. Or else get a loan from the nearest bank. capital now loan app review.

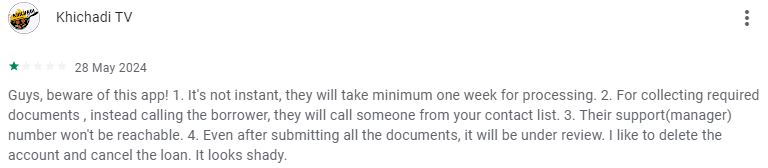

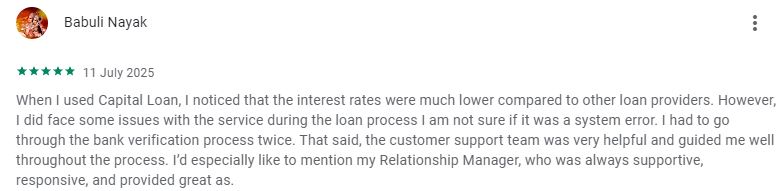

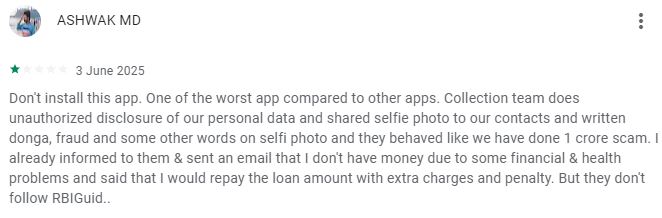

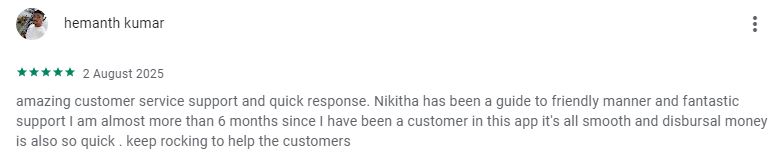

Real Customer Review Screenshots

Pros & Cons of Capitol Loan App

Pros

- Quick approval & disbursal

- 100% digital process

- No foreclosure penalty

- Extra bill-pay & rewards options

Cons

- Only for salaried professionals

- High minimum salary requirement (₹30K)

- Occasional app-related complaints

Conclusion

If you’re a working professional earning ₹22,000 or more, Capital Now Loan App is a reliable option for small, short-term loans. It’s fast, secure, and transparent. Just be mindful of the interest rates and ensure timely repayment to avoid late fees. Also read terms and conditions carefully before applying for the loan. We always advise not to borrow loans from loan apps. We always gather maximum information from the internet and try to review these loan applications. Capital Now Loan App Review gives you a clear structure about the capital loan app.

Hope Capital Now Loan App Review article gives you good knowledge about the Capital Loan App. Here We would like to warn about the fraudulent loan apps working towards scamming the customers, especially the people who are in need of money in the present days. We request please read and understand carefully about the loan applications and their existence before applying for a loan. We only provide information regarding loan apps and their features and also about the trustability of those loan apps through our reviews. We are not responsible for your loss and gain at all.

Important Contacts Details

Contact Number: 1860-500-5588, 7793999075

Customer Care Number: 1860-500-5588

Email Address: info@capitalnow.in, support@capitalnow.in, grievance@capitalnow.in

Office Address: KKR Square, Jubilee Hills, Hyderabad TG 500033 IN

Important Links

Capital Loan App Official Website: Click Here

Download Capital Loan App From Google Play Store: Click Here

Download Capital Loan App From App Store: Click Here

Apploan Home Page: Click Here

- $500 Dollar Loan: Get Instant 500 Dollar Loan Online in the USA 2025

- SmartCoin Loan App Review 2025: Real or Fake? How to Apply for Loan in SmartCoin App?

- Olyv Loan App Review 2025: Real or Fake? How to Apply for Loan in Olyv App?

- Navi Loan App Review 2025: Real or Fake? How to Apply for Loan in Navi App?

- CASHe Loan App Review 2025: Real or Fake? How to Apply for Loan in CASHe App?

- IndiaLends Loan App Review 2025: Real or Fake? How to Apply for Loan in IndiaLends App?

FAQs

Q: What’s the maximum loan amount you can get from the Capital Loan App?

A: You can get up to ₹1,50,000

Q: Are there foreclosure charges in the Capital Loan App?

A: No, you can close the loan early without penalties.

Q: How soon will I get the money after applying for a loan in the Capital Loan App?

A: Usually you will get your loan amount within 10 minutes after approval.

Q: Who can apply for a personal loan in the Capital Loan App?

A: Salaried individuals with ₹30,000+ monthly income.

Q: What is the interest rate of Personal Loan in the Capital Loan App?

A: 22.% pa

Q: Is capital now loan app rbi registered or not?

A: Yes, capital now loan app is rbi registered

Q: Is capital now loan apps safe or not in India?

A: It is safe to use in India