DigiMoney Finance Loan App Review: Here is another finest money lending app called DigiMoney Finance Loan App. We are providing complete details about the DigiMoney Finance Loan App. Also we review this loan app. When it comes to personal loans, many people prefer apps that are quick, transparent, and RBI-approved. One such option gaining attention is the DigiMoney Finance Loan App. But how does it really work, and is it safe to use? Let’s go step by step and find out.

DigiMoney Finance Loan App Review article will make it clear whether you can use this app or not. In this article we will cover key features of DigiMoney Finance Loan App, Loan Types, eligibility criteria to get loan from DigiMoney Finance, benefits of DigiMoney Finance Loan App, Important contacts of DigiMoney Finance Loan App, how to use DigiMoney Finance Loan App,DigiMoney Finance Loan App Real or Scam?, DigiMoney Finance Loan App real or Fake.

Before moving to more information about the DigiMoney Finance Loan App Review, we would like to warn about the fraudulent loan apps working towards scamming the customers, especially the people who are in need of money in the present days. We request please read and understand carefully about the loan applications and their existence before applying for a loan. We only provide information regarding loan apps and their features and also about the trustability of those loan apps through our reviews. We are not responsible for your loss and gain at all.

About DigiMoney Finance

The DigiMoney app is developed by DigiMoney Finance Private Limited, an NBFC registered with the Reserve Bank of India. That means the company is regulated and operates under RBI lending guidelines. This app provides various loans for different uses with its best interest rate. DigiMoney Finance Loan App Review.

Key Features

- Loan Amounts: From ₹10,000 up to ₹1,00,000

- Tenure: 3 to 12 months repayment period

- Interest Rate: 10% – 24% annually, depending on your profile

- Processing Fee: ₹500 (one-time, deducted upfront)

- Cities Covered: Currently available in Chennai, Bangalore, Hyderabad, Coimbatore, Mysore, Salem, and nearby regions

- Lowest Interest rate at flat at ₹ 1000

How to use DigiMoney Finance Loan App?

- First you need to Download the app from Google Play or App Store using the given link below.

- Then Register with your name, mobile number, and email

- Complete e-KYC using your PAN and date of birth details

- Check loan eligibility (the app instantly shows pre-approved offers)

- Select loan details such as amount and EMI plan

- Receive disbursement directly into your bank account

Who Can Apply for DigiMoney Finance Loan?

- Must be an Indian citizen aged 21 or above

- Should be salaried with at least ₹10,000 monthly income

- Must have a valid PAN card and a mobile number linked to Aadhaar

- Reside in one of the supported cities

Benefits of DigiMoney App

- RBI-regulated NBFC ensures trust and compliance

- Completely paperless process – loans approved and disbursed in minutes

- Lower interest rates compared to most instant loan apps

- User-friendly interface with simple navigation

- Ethical lending practices backed by transparent terms

Things to Keep in Mind

- The ₹500 processing fee can feel high for small loan amounts

- Service is still limited to select regions

- The app requires permissions like SMS, contacts, and storage, which some users may find intrusive

Is DigiMoney Safe or Fake?

Unlike many shady loan apps, DigiMoney is 100% safe and genuine. It’s run by a company that’s officially registered with RBI as an NBFC. That makes it far more reliable than unregulated apps that often harass borrowers or misuse data. DigiMoney Finance Loan App Review.

In this DigiMoney Finance Loan App Review article, we would like to warn about the fraudulent loan apps working towards scamming the customers, especially the people who are in need of money in the present days. We request please read and understand carefully about the loan applications and their existence before applying for a loan. We only provide information regarding loan apps and their features and also about the trustability of those loan apps through our reviews. We are not responsible for your loss and gain at all.

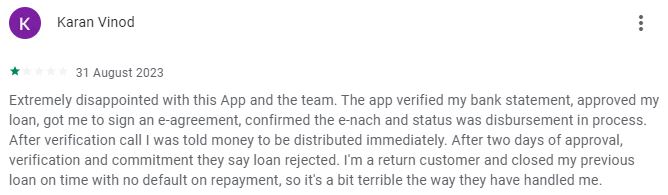

Common Complaint about the DigiMoney Finance Loan App

Check the list of some common complaints against the DigiMoney Finance Loan App which is collected from Google Play Store given by real users. These points may give you a good idea about the loan app. Also these points are considered best points for DigiMoney Finance Loan App review.

- Not disbursing the money even after signing e-mandate and loan agreement

- Unable to complete KYC

- Complaint about technical issue

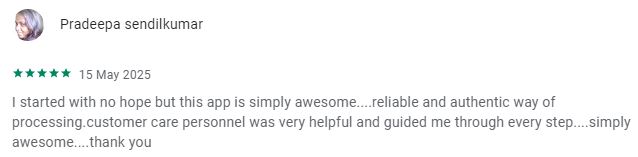

Real Customer Feedback Screenshot

Find a screenshot of real users feedback given in Google Play Store. DigiMoney Finance Loan App Review.

Important Contact Details

Contact Number: 18005728428

Customer Support Number: 18005728428

Email Address: info@digimoneyfinance.com

Postal Address: 4th floor, Salzburg Square, 107, Harrington Road, Chetpet, Chennai – 600 031

Important Links

DigiMoney Finance Loan App Official Address: Click Here

Download DigiMoney Finance Loan App from Google Play Store: Click Here

Download DigiMoney Finance Loan App From App Store: Click here

Get Instant 50000 Personal Loan: Click Here

Conclusion

As we found on the internet, there are many complaints registered regarding the DigiMoney Loan App. Not even a single fraudulent case has been registered on the internet. If we find in google play store very fewer complaints can be seen. So as per our review, you can use this app for loan. But make sure you are only responsible for your decision.

The DigiMoney Loan App is best suited for salaried individuals who need small, short-term loans quickly. If you live in one of the supported cities, it’s a solid option thanks to its transparency and RBI regulation. However, borrowers should calculate costs carefully because of the flat processing fee. Hopefully DigiMoney Finance Loan App Review gave you genuine information about the loan app.

In this DigiMoney Finance Loan App Review article, we would like to warn about the fraudulent loan apps working towards scamming the customers, especially the people who are in need of money in the present days. We request please read and understand carefully about the loan applications and their existence before applying for a loan. We only provide information regarding loan apps and their features and also about the trustability of those loan apps through our reviews. We are not responsible for your loss and gain at all.

Read Also

- $500 Dollar Loan: Get Instant 500 Dollar Loan Online in the USA 2025

- SmartCoin Loan App Review 2025: Real or Fake? How to Apply for Loan in SmartCoin App?

- Olyv Loan App Review 2025: Real or Fake? How to Apply for Loan in Olyv App?

- Navi Loan App Review 2025: Real or Fake? How to Apply for Loan in Navi App?

- CASHe Loan App Review 2025: Real or Fake? How to Apply for Loan in CASHe App?

- IndiaLends Loan App Review 2025: Real or Fake? How to Apply for Loan in IndiaLends App?

FAQs

Q: What is the maximum loan I can get from DigiMoney Finance Loan App?

A: Up to ₹1,00,000, depending on eligibility.

Q: What are the interest rates in DigiMoney Finance Loan App for personal loan?

A: Between 10% and 24% per annum

Q: How long does loan disbursement take in DigiMoney Finance Loan App?

A: Usually within minutes after approval.

Q: Can I pre-close the loan in DigiMoney Finance Loan App?

A: The app doesn’t clearly state prepayment charges, it’s best to check with customer support

Q: Is DigiMoney approved by the RBI?

A: Yes, it is managed by DigiMoney Finance Pvt. Ltd., an RBI-registered NBFC

Q: When was DigiMoney Finance Loan App founded?

A: Operated by DigiMoney Finance Pvt. Ltd., founded in 2023.

Q: Who founded the DigiMoney Finance Loan App?

A: Managed by the team at DigiMoney Finance Private Limited.