InCred Loan App Review: Here we come up with another familiar loan app called InCred Loan App. We tried to review genuinely about this loan app. We have taken help from AI to write the outline of the article. But we have researched the real information using google. So you can trust our information given in the ‘’InCred Loan App Review’’ article. Read the full article on our InCred Loan App Review 2025 to know if the loan app is real or fake, how to apply, eligibility, documents, interest rates, complaints, and customer care details.

Before moving to more information about the InCred Loan App Review, we would like to warn about the fraudulent loan apps working towards scamming the customers, especially the people who are in need of money in the present days. We request please read and understand carefully about the loan applications and their existence before applying for a loan. We only provide information regarding loan apps and their features and also about the trustability of those loan apps through our reviews. We are not responsible for your loss and gain at all.

What is InCred Loan App?

InCred loan app is another digital lending platform that provides instant personal loans, education loans, and business loans. The app is designed to make borrowing simple and paperless. Instead of waiting for weeks like traditional banks, InCred promises fast approval and quick disbursement, making it a go-to choice for young professionals and students. InCred Loan App states it is RBI registered loan app offering fast loan.

Key Features of InCred Loan App

- 100% Online KYC Process available

- Competitive Loan Interest Rates: Starting – 13.99% p.a.

- Flexible Cash Loan Repayment Tenure: 12 – 60 months

- Customizable Cash Loan & Tenure

- Automatic EMI Deduction via eNACH Mandate

- Repayment Facility available using UPI

- More than 1 Million app downloads

- ₹25,000 Cr Loan Distributed

- 2,600+ employees working in this organisation

Key Facilities Available on InCred Loan App

- Personal Loans – For medical emergencies, travel, weddings, shopping, or debt consolidation.

- Education Loans – For both Indian and international studies.

- Business Loans – For small entrepreneurs and startups.

- Quick Processing – Loan approval within minutes (for eligible applicants).

- Paperless KYC – Everything happens online via Aadhaar, PAN, and bank verification.

Available Loan on InCred Loan App

- Personal Loan

- Education Loan

- Merchant Loan

- Supply Chain Finance

- Loan Against Property

How to Apply for a Loan in InCred App

- Download the InCred App from the Google Play Store or Apple App Store.

- Register with your mobile number and verify using OTP.

- Fill out personal details like income, job type, and loan requirement.

- Upload required documents (PAN, Aadhaar, bank statement, etc.).

- Wait for approval – usually takes minutes to a few hours.

- Get money credited directly to your bank once approved.

Eligibility Criteria

Before applying for the loan in the InCred Loan app, make sure you meet below conditions.

- Loan Applicant age must be between 21 to 55 years

- Applicant must have a regular source of income (salaried or self-employed)

- Applicant must have Valid KYC documents, such as PAN Card, Aadhaar Card

- Applicant must have minimum monthly income requirement (varies by city and loan amount)

Required Document to apply for InCred Loan App

- PAN card

- Aadhaar card / Voter ID / Passport (any one)

- Recent passport-size photo

- Bank account statement / salary slips

Is InCred Loan App Real or Fake?

InCred is a legit Loan App and it is an NBFC registered with RBI. The InCred Loan App has been operating since 2016. The InCred Loan App Review article can make you clear about the originality of this loan app. We have provided maximum information about this loan app in InCred Loan App Review 2025. However, like any lender, loan approval depends on your eligibility and creditworthiness.

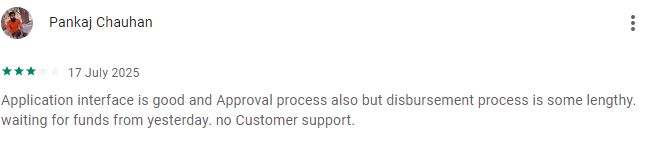

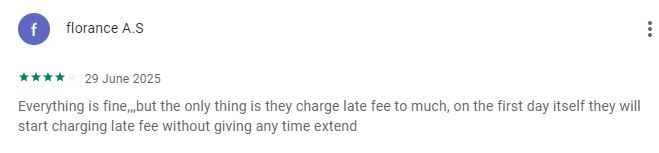

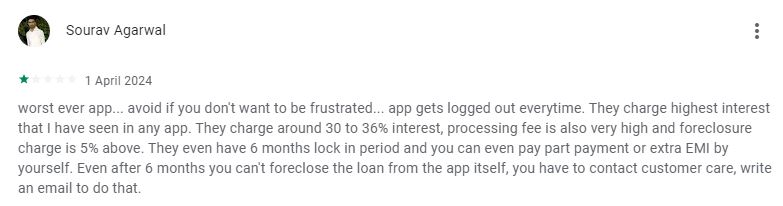

We will not say it is a fake app. Because it has met all the required criteria to be an original app. Such as InCred App is registered under RBI NBFC, this app is available on Google Play Store and App Store. Also InCred Loan App has good ratings on online and play stores. Some users have complained about the app’s technical issue and high interest rates. We have provided real users screenshot taken from Google Play Stores. Now your decision to take a loan from this app or not. InCred Loan App Review.

Common Complaints About InCred Loan

- Higher interest rates compared to banks

- Hidden charges if repayment is delayed

- Customer care delays during peak times

- Unexpectedly app closes working

- No Proper response

- App gets logged out everytime

Foreclosure & Prepayment Rules

InCred allows loan foreclosure (closing loan early), but charges may apply. Always confirm foreclosure fees with customer support before paying off the loan early. It’s advisable to read the loan agreement carefully before applying. As per customer reviews, they have complained about hidden charges and repayment delay charges. So be careful about this. Read carefully all the instructions. InCred Loan App Review.

Contact Details of InCred Loan App

Customer Care Number: 18001022192, +9118605002192

Whatsapp Number: +918826272192

Email: care@incred.com

Postal Address: Unit No. 1203, 12th floor, B Wing, The Capital, Plot No. C – 70, G Block, Bandra – Kurla complex, Mumbai-400051

Important Links – InCred Loan App Review

Official Website of InCred Loan App: Click Here

Whatsapp Link in InCred Loan App: Click Here

Download InCred Loan App From Google Play Store: Click Here

Download InCred Loan App From App Store: Click Here

InCred Loan App – Final Review

If you need quick, short-term loans without heavy paperwork, InCred can be a good option. But if you are looking for low-interest long-term loans, you might want to compare with banks. We will not say don’t go with InCred Loan app for loan, but if you are not bothered about interest then it is the best option for a quick loan. Most customers have complained about the highest interest rate and hidden charges for delayed payment. So check every review about the loan app before borrowing the loan. InCred Loan App Review article has given brief details about the InCred Loan App.

Customer Review Screenshot

Conclusion for InCred Loan App Review

The InCred Loan App is a genuine platform that provides quick personal loans in India. We can say it is safe, because this app is NBFC RBI-registered, and it is available on Google Play Store and App Store for download. Already More than 10 Lakh people have downloaded the app. It offers multiple loan options. Just ensure you understand the interest rates and repayment terms before applying.

Tags to Reach InCred Loan App Review Article: incred loan app address, incred loan app is safe or not, incred loan application status check, incred loan login, incred loan statement, incred loan id number, Pay InCred Loan EMI Online, InCred Loan Repayment, Pay Incred Loan EMI Online, InCred Loan App Review, incred finance review, InCred Finance is safe or not, InCred Finance review, InCred Finance customer care number, InCred Finance RBI approved, InCred Finance Login, InCred Finance app, InCred Finance rate of interest, InCred Finance loan status.

Read Also

- $500 Dollar Loan: Get Instant 500 Dollar Loan Online in the USA 2025

- SmartCoin Loan App Review 2025: Real or Fake? How to Apply for Loan in SmartCoin App?

- Olyv Loan App Review 2025: Real or Fake? How to Apply for Loan in Olyv App?

- Navi Loan App Review 2025: Real or Fake? How to Apply for Loan in Navi App?

- CASHe Loan App Review 2025: Real or Fake? How to Apply for Loan in CASHe App?

- IndiaLends Loan App Review 2025: Real or Fake? How to Apply for Loan in IndiaLends App?

FAQ

Q: Who is eligible for InCred Loan?

A: Any salaried or self-employed Indian aged 21–55 with valid KYC documents.

Q: How do I close my InCred Loan?

A: You can request foreclosure via the app or customer care (fees may apply)

Q: What is the interest rate of InCred Loan?

A: Rates generally range between 16% to 30% per annum, depending on your profile.

Q: What is the customer care number of InCred Loan App?

A: Check the app or website for the updated helpline number.

Q: What is the age limit to apply for a loan in InCred?

A: Minimum 21 years, maximum 55 years.

Q: When was InCred founded?

A: InCred was launched in 2016.

Q: Who is the founder of InCred?

A: It was founded by Bhupinder Singh, former Deutsche Bank executive.